Property Tax Overview

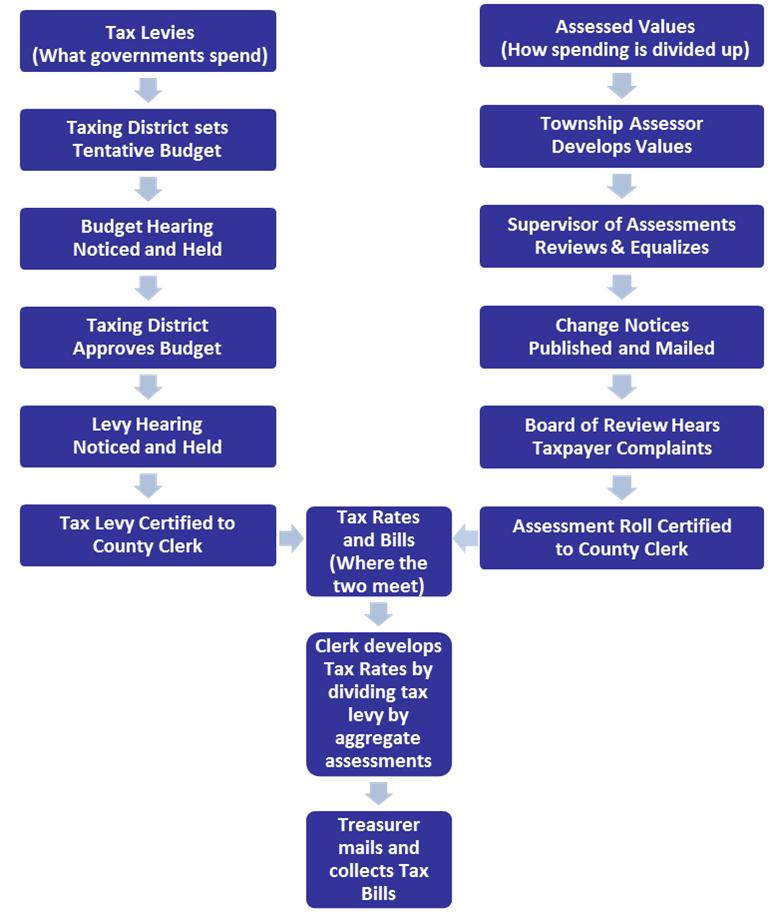

Under Illinois law, property tax are the primary means of funding local governments. Property taxes are developed from two components: the taxes levied by each local government taxing district, and the relative value of each taxable parcel in the boundaries of each taxing district. Simply put, the Illinois property tax system divides up each local government taxing district’s property tax levy over all parcels in the district, based on each parcel’s proportionate assessed value as a percentage of the aggregate assessed property value in the district.